4 Month Residential Programme

at Manipal Academy of BFSI Campus, Bengaluru Earn ₹5,000 Per Month As Stipend

2 Months internship

At HDFC Bank Branch Earn ₹10,000 Per Month As Stipend

6 Months On-The-Job Training

At HDFC Bank Branch Start Earning 100% Of CTCJob Description Personal Banker (Sales)

The role Personal Banker-Sales is responsible for portfolio management by acquisition of new customers and enhancement of the relationship by cross-selling products and services as per the profile & need of the customers following the bank policies and processes. Acquiring family accounts, deepening the banking relationship and retention of customers would be some of the key job responsibilities. Successful candidates would achieve this by being the dedicated point of contact for these customers, ensuring top class customer service and following the operational guidelines of the Bank.

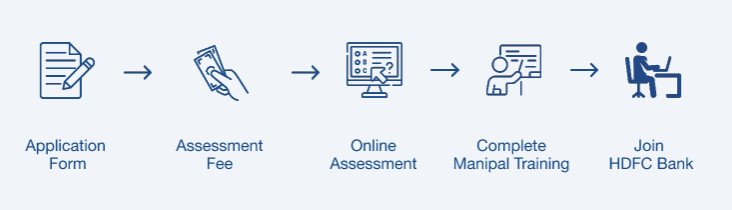

Download Job DescriptionRegistration Process

Enrol

Equip

Evolve

Get awarded a Post Graduate Diploma in Sales and Relationship Banking from Manipal Academy of Higher Education on successful completion of the course

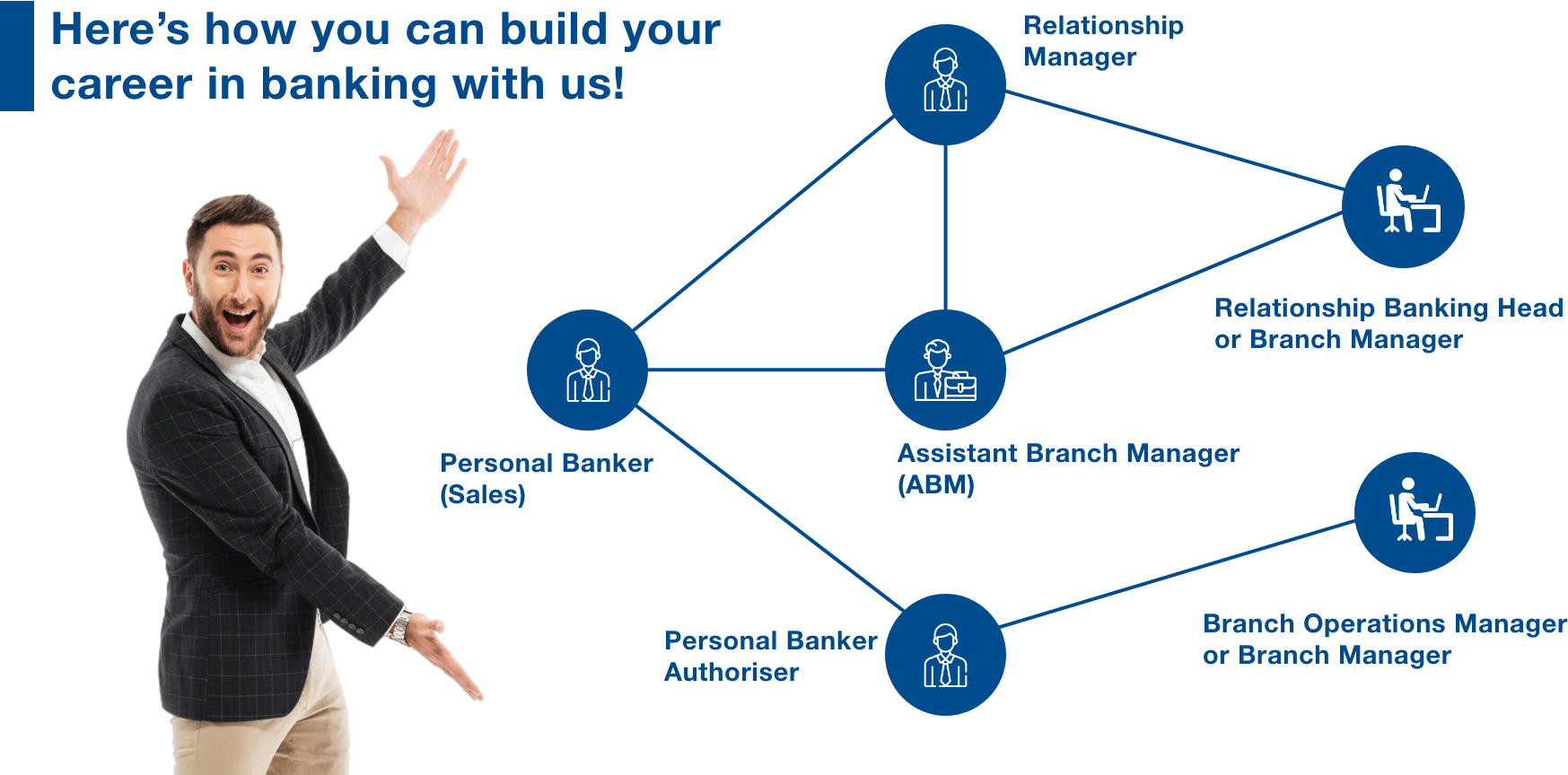

Placement Opportunity as a Personal Banker with HDFC Bank

Earn

Earn while you learn!

Out of pocket expenses every month for 6 months during campus training and internship

Start earning 100% of your CTC from Day 1 of On-The-Job Training

Programme Features

A 12-month paid programme with exposure at any of the HDFC Branch locations within the country to further strengthen your knowledge in banking products, processes, compliance framework and day-to-day banking operations

Job Opportunity as a Personal Banker at the grade of Deputy Manager with HDFC Bank on successful completion of the course

A Post Graduate Diploma in Sales & Relationship Banking

Eligibility Criteria

Full time graduation degree in any discipline from a recognized University or any equivalent qualification recognized by Central Government.

Anyone between the age group of 21-28 years.

CIBIL Score less than 720 (Candidates with no CIBIL Score, reflected as 0 or -1, or above 720 are eligible).

Programme Fees

₹2,37,288 + GST- Loan - Education loan facility available at 11.75% interest

- Self Fund - Payment in two installments during the program

Why Join?

How is Future Bankers 2.0

program different?

The programme has been structured to specifically create a pool of first level bankers. It equips aspirants with the skill sets and the knowledge required to step into the real world with utmost confidence.

The placement opportunity of the programme gives young minds an opportunity of accelerated growth and seamless transition into the workforce.

The programme concentrates heavily on the more practical aspects of learning making it more professional than other programs in the same category.

This is a great opportunity for individuals to become a part of HDFC Bank, one of India’s foremost brands reputed for its rich legacy of innovation, transparency and honesty.

At ₹2,37,288 + GST which includes boarding charges for the first 4 months of on-campus training, the programme is immense value for money as compared to other professional courses in the same category.

Start earning 100% CTC from Month 7.

Sales as a Career

“Sales is contingent upon the attitude of the salesman, not the attitude of the prospect.”

-William Clement Stone

True, rejection is a part of Sales, but what aspect of life comes without rejection? If you sell well, you can do almost anything - irrespective of how the economy is doing. That’s the reason sales professionals are always in demand.

Research shows that women’s win rates in sales are 11% higher than men’s (on an average). Studies also suggest that women close deals at a higher rate than men. HDFC Bank particularly promotes a culture of inclusion, so who said sales is not for women?!

Every job has its own targets and pressures. Sales is no exception, however, careful planning and goal-setting will ensure impeccable results.

More often than not, introverts close more sales than extroverts because introverts are better listeners. Always remember: Master sales professionals are master listeners.

About Manipal Academy of BFSI

Manipal Academy of BFSI is India’s leading learning solution provider for the BFSI sector. Started under the leadership of Dr.Ramdas Pai (Chancellor of Manipal Academy of Higher Education & Chairman Emeritus, Manipal Global Education Services) the Academy has partnered with over 50 leading banks, insurance and non-banking financial organizations and has trained over 2,00,000 professionals in the industry. With the latest technology and co-created curriculum based on the expected outcome, we create an immersive learning experience. With the help of our course, aspiring bankers can now easily align their competencies with the industry requirements.

About HDFC Bank

HDFC Bank is one of India’s leading private banks and was among the first to receive approval from the Reserve Bank of India (RBI) to set up a private sector bank in 1994. As of June 30, 2025, the Bank’s distribution network was at 9,499 branches and 21,251 ATMs across 4,153 cities / towns as against 8,851 branches and 21,163 ATMs across 4,081 cities / towns as of June 30, 2024. 51% of our branches are in semi-urban and rural areas.

The Bank’s international operations comprise four branches in Hong Kong, Bahrain, Dubai and an IFSC Banking Unit (IBU) in Gujarat International Finance Tech City. It has five representative offices in Kenya, Abu Dhabi, Dubai, London and Singapore. The Singapore and London offices were representative offices of erstwhile HDFC Limited and became representative offices of the Bank post the merger. These are for providing loans-related services for availing housing loans in India and for the purchase of properties in India.